Global bond yields jumped, and Australian rates climbed to a high for this year as traders increased bets the Reserve Bank would return to tightening.

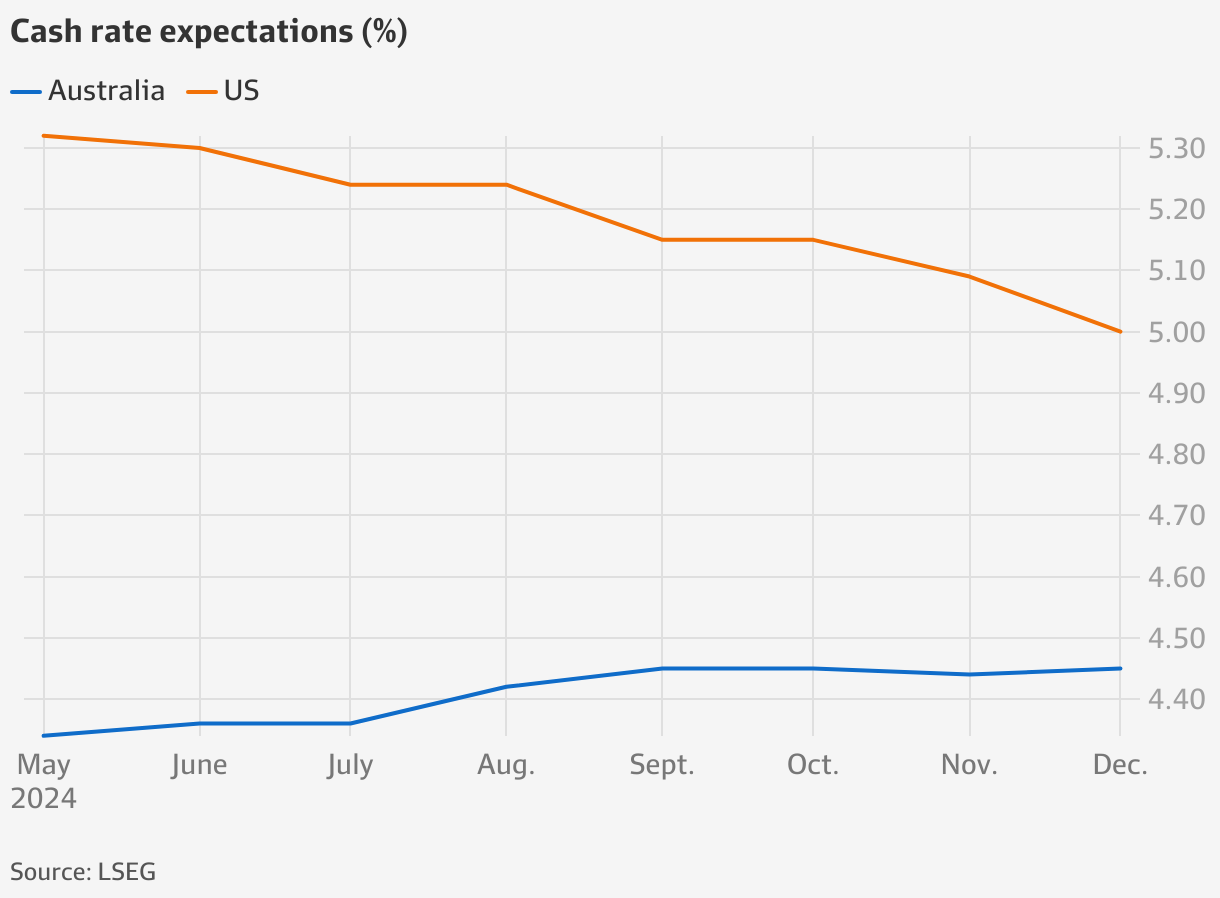

Australia is the only major economy where traders are primed for the chance of a rate increase. In the US, they are betting that the Fed’s next move will be down.

For New Zealand, Europe, the UK, and Canada, the market ascribes between 1 basis point and 16 basis points of rate cuts at their next policy meetings. This compares with 2 basis points or a 7 per cent chance of a rate rise to 4.6 per cent at the RBA’s meeting next month.

“When you compare Australia to other economies, they are much closer to their neutral real level with their policy rates of 5 per cent and inflation around our level,” said Fortlake Asset Management co-founder Christian Baylis. “This means the RBA ultimately has more to do. I think three rate hikes at the minimum, as we are getting more inflation symptoms, not less.”

He said there were not enough restrictions in the current policy settings to stop inflation from accelerating once again.

“It is like a course of antibiotics. The last thing you want is to stop taking the antibiotics because if you stop, what happens is inflation potentially re-emerges bigger,” he said. He expected the Reserve Bank would digest the data at its coming policy meeting, and ascribed a 50:50 chance it would raise the cash rate at the June 18 meeting.

Bond yields soar

In its March policy decision, the RBA concluded that it remained “resolute in its determination to return inflation to target” and said it was “not ruling anything in or out”.

Yields on Australia’s policy-sensitive three-year government bonds soared 12 basis points to 4.16 per cent, a level last seen in November last year. If maintained, this would be the biggest weekly gain in nearly a year. The return on 10-year bonds jumped 15 basis points to a five-month top of 4.55 per cent. The sharp moves were exacerbated by Thursday’s Anzac Day holiday when the bond market was shut.

Andrew Lilley, chief rate strategist at Barrenjoey, said the moves in the past two days were the biggest in the past six months, reflecting a drastic shift in RBA expectations.

“This could continue as everybody is reassessing how far this could go and the distribution of risks is getting tilted to the upside,” he said.

Speculative funds were wrong-footed. “Even though the RBA would be slow to cut, hedge funds had taken a position that they still would cut this year,” he said.

On Thursday, data showed the US economy expanded at its slowest pace in nearly two years in the first quarter, but a rise in inflation revived the spectre of stagflation – a combination of elevated inflation and slowing activity – reinforcing expectations that the Fed would not cut interest rates before November.

US gross domestic product rose at an annualised pace of 1.6 per cent in the three months to March, well under forecasts of 2.4 per cent.

While his base case is a rate cut at the end of 2024, AMP chief economist Shane Oliver conceded there was now a high risk of another rate hike.

“The combination of sticky services inflation will leave the RBA cautious and still waiting for greater confidence that inflation will return to target in a reasonable time frame and it’s likely to signal this at its May meeting,” Dr Oliver said.

“The RBA will likely also debate whether another rate hike is needed. We don’t think it will be or that the RBA will hike again, but it is likely to reinstate its tightening bias and another rate hike is now a high risk.”

Source: afr.com

George Barham, an accomplished journalist and avid gambling enthusiast, serves as the esteemed Editor-in-Chief at fly-to-australia.com, Australia’s leading source for comprehensive gambling news and insights. With an unwavering passion for both the written word and the ever-evolving world of betting and gaming, George brings a wealth of knowledge and expertise to the helm of our editorial team.